Show your patients that you are dedicated to helping them maximize their benefits for dental sleep procedures. Find out how by reading this article by Courtney Snow and Rose Nierman.

by Courtney Snow and Rose Nierman

“How much is this going to cost me?” Sound familiar? Financial discussions do not need to be a difficult or dreaded conversation for the dental practice team but can be an opportunity to gain trust and confidence with your patients. You can help your patient understand their medical insurance benefits (which have probably never been explained to them before).

For dental practices billing their patient’s medical insurance as out-of-network providers, the answer to this question may not be as straightforward as one would hope; especially for the first few claims filed. The reason for this is because commercial medical insurers do not typically reveal the Usual, Customary, and Reasonable (UCR) fees. UCR is the maximum dollar amount a medical plan will consider or the “allowed amount” for services. When billing medical insurance as an in-network provider, this figure is already known because the provider has a contracted allowed amount determined while enrolling in the insurer’s network.

However, this leaves the out-of-network dental practice saying, “Ok, the medical benefits verification we performed revealed coverage at 80% – so the real question is – 80% of what?” That “of what,” paired with a bit of simple math, is the key to estimating out-of-pocket costs as accurately as possible.

The good news is, estimating out-of-pocket costs when billing medical insurance as an out-of-network provider becomes easier over time. Although medical plans vary, you can estimate future allowed amounts after having processed a claim or two. Why? The elusive allowed amount is on the Explanation of Benefits (EOB) received after the claim is processed. We will share some tips from Nierman Practice Management to help this conversation go smoothly, stay on track, and ensure the information gathered during the benefit verification can be used to provide the patient with an approximation.

-

Verify medical insurance benefits before the appointment when possible.

When you verify the benefits before the appointment, you have the information to begin this discussion. Although you may not yet know precisely what the medical insurer allows for the services you render, you will be able to confirm the remaining deductible amounts and co-insurance percentages.

-

Use positive language confidently.

When a patient asks if the service is covered by insurance, use positive language such as “Great news! – Yes, many patients can use their medical insurance benefits to help cover the costs of treatment. This means you can save your dental insurance benefits for dental procedures not covered by medical insurance.”

-

Break the costs down into bite-sized pieces.

Break fees down into a monthly or even daily cost! For example, for a custom-made oral appliance for sleep apnea, when estimating out-of-pocket expenses of $1200, you can let the patient know that “these appliances often last for five years, so for the equivalent of about $20 a month, or about $0.66 per night, this therapy can help you sleep and breathe better.”

-

Be sure the patient understands the deductible.

No one likes deductibles, but if the patient still has a deductible remaining, it can only be waived in cases where there is a genuine, documented financial hardship. Even if a large amount of your treatment fee applies to the deductible (meaning the patient pays you that amount out-of-pocket), you should present this as a positive to the patient. “Once this claim processes, your deductible is met for the remainder of the year!”

-

Pull it all together (do the math)

You’ll need four main things to make the estimate happen: the remaining deductible amount, coverage percentage, your fee, and the estimated allowed amount. For example, let’s say you are an out-of-network provider and your fee for a custom-made oral appliance for sleep apnea (HCPCS code E0486) is $3200. On a claim you previously filed to this medical plan, the allowed amount for E0486 showed as $2500. When you verified the patient’s medical benefits, you found there is $500 remaining on the deductible, and the patient is covered at 80% of the allowed amount once the deductible is met. See figure 1 for an example estimate.

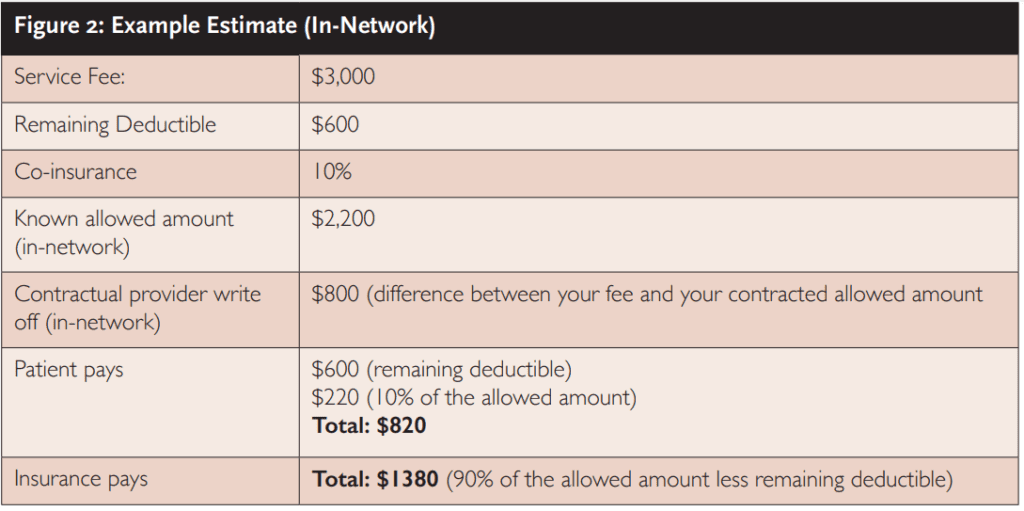

As another example, this time, let’s say you are an in-network provider, and your fee for E0486 is $3000. Your contracted allowed amount for this insurer is $2200. When you verified the patient’s medical benefits, you found $600 remaining on the deductible, and the patient is covered at 90% of the allowed amount once the deductible is met. See figure 2 for an example estimate.

We would be remiss if we didn’t mention that it is essential that the patient understand that you are only estimating the reimbursement vs. out-of-pocket costs. Many factors play into the ultimate results of the claim being processed – many that are not within your control! For example, a claim may process from another provider the patient has seen between your verification & your processed claim. Part (or all) of the deductible you estimated the patient still owed is now satisfied. Or the plan may pay a different allowed amount this time around. So, a lot can happen in the interim.

The moral of this story is: although you don’t have a magic crystal ball to predict the exact amount your patient’s medical insurance will reimburse, we hope you apply these tips and tools to make your patients feel confident that you are dedicated to helping them maximize their health benefits while providing an approximation of benefits that is as accurate as possible.

For more information about how to maximize your patients’ benefits for dental sleep, check out another article by Rose Nierman, “Let Technology Help You Streamline Medical Billing” here:

https://dentalsleeppractice.com/let-technology-help-you-streamline-medical-billing/

As Director of Training and DentalWriter™ Software Implementation at Nierman Practice Management, Courtney Snow is well-known in the Dental Sleep Medicine industry for her work with medical insurance reimbursement for Oral Appliance Therapy for obstructive sleep apnea, temporomandibular disorders, oral surgery and other medically necessary services performed in the dental practice setting.

As Director of Training and DentalWriter™ Software Implementation at Nierman Practice Management, Courtney Snow is well-known in the Dental Sleep Medicine industry for her work with medical insurance reimbursement for Oral Appliance Therapy for obstructive sleep apnea, temporomandibular disorders, oral surgery and other medically necessary services performed in the dental practice setting. As founder & CEO of Nierman Practice Management, Rose Nierman is a pioneer and icon in establishing systems, education, and training for dentists. For 33 years, Nierman’s Crosscoding; Medical Billing in Dentistry courses, DentalWriter Software, and billing services have helped thousands of dentists implement Dental Sleep Medicine, TMD, and medical billing. For more information: contactus@dentalwriter.com or 800-879-6468.

As founder & CEO of Nierman Practice Management, Rose Nierman is a pioneer and icon in establishing systems, education, and training for dentists. For 33 years, Nierman’s Crosscoding; Medical Billing in Dentistry courses, DentalWriter Software, and billing services have helped thousands of dentists implement Dental Sleep Medicine, TMD, and medical billing. For more information: contactus@dentalwriter.com or 800-879-6468.